A marketing strategy should always begin with the identification of the most valuable customers. In this sense, we firstly need to determine the value of a customer.

But what does „valuable“ actually mean and how do you determine the value of customers?

Customers who help the company to achieve their (economic) goals are valuable.

Most companies are sales and profit oriented, i.e. the most valuable customers help, more than others, to increase sales and/or maximize profit. However, this is not only directly dependent on the customer’s contribution to revenue and profit, but also on other quantitative and qualitative KPIs. They help with a more holistic evaluation of customers.

The most important key performance indicators at a glance

| Quantitativ | Qualitativ |

| Size of wallet | Cross-selling potential |

| Turnover | Up-selling potential |

| Contribution margin | Recommendation rate |

| Purchase frequency (frequency) | Loyalty |

| Time since last purchase (recency) | Engagement |

| Price elasticity/ willingness to pay | Contribution to product development |

| Time to conversion | Contribution to own know-how base |

| Discounts | Relevance as reference customer |

| Contract costs | Contribution to corporate image |

| Acquisition costs |

Ideally, the key figures are not only used in their status quo, but also as assumptions about the future situation (e.g., expected future sales, future willingness to pay).

Different datasets for new/ existing/ contractual customers

In the evaluation method, it is also helpful to distinguish between new and existing customers, as well as between contractually bound and unbound customers. In this way, the different data depths can be considered.

Common valuation methods

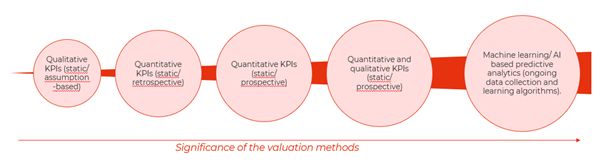

Based on the business objectives and of course depending on the availability of customer data, each company can choose the appropriate evaluation system.

The simplest is the ABC analysis. Here the customers are valued by their turnover or contribution margin (retrospectively) into A, B and C-customers. This classi-fication is however very rough and considers only the present financial value of the customers. It also leaves open, for example, the customer costs or additional benefits of the customer relationship.

A more prospective view is the RFM method. Here, customers are categorized according to their recency, frequency (see KPIs) and monetary (revenue/ contribution margin). However, this method is primarily used to control marketing activities (direct marketing/ promotion), as it is aimed more at the next purchase and not the longer-term customer value. The same applies to models that primarily include customer engagement (e.g. CRV = Customer Referral Value, CIV = Customer Influence Value, CKV = Customer Knowledge Value).

In addition, there are scoring models. These offer maximum flexibility and individuality in calculating customer value. Here, any number of quantitative and qualitative KPIs can be included with an individually selected weighting, and thus the value of the customer can be determined. Strategic aspects as well as prospective KPIs can be taken into account. The disadvantage is the subjective selection, evaluation and weighting of the KPIs, which makes such models less reliable.

More objectively, the customer lifetime value (CLV) calculates the value of the customer over the business relationship duration. The current and expected revenue of the customer is calculated minus the current and expected investment in this customer as well as a discounting over the duration of the business relationship.

There are some extensions to the CLV that include additional KPIs and thus also softer factors such as recommendation, cross-selling potential, and commitment.

The role of machine learning, big data and AI

The determination of customer value becomes really exciting above all through ongoing data collection, big data and AI, or machine learning. Here, the (automatically) collected customer data becomes better and better at predicting future behavior by means of learning algorithms and thus determines the value of customers even more reliably.

The prerequisite for this, however, is a powerful data analytics system architecture that reliably delivers high-quality (i.e., complete, valid, consistent, accurate and up-to-date) data.

Likely, many companies are probably still a long way from an effective, data-based customer value management. In such cases, it is advisable to start with simpler methods and create the data analytics system architecture in parallel in order to be able to make more intelligent and automatic assessments in the future.

The effort is worth it

And why go to all the trouble of evaluating and categorizing the customer? Quite simply, the better a company focuses on the customers who are really valuable, the lower the risk of bad investments in product development (fewer product flops) and marketing (less wastage!) and the more efficient sales are (more time with valuable customers, less time with non-valuable customers) amongst other benefits.

Now you know how to determine the value of customers! The next step will be to get a in-depth understanding of who these customers are. Read more about this next step here.

Learn more about the benefits and the idea of focusing on your most valuable customers here at www.customer-centricity.org

Sources:

https://link.springer.com/book/10.1007/978-3-658-10920-2

https://wsp.wharton.upenn.edu/book/customer-centricity-playbook/

https://biopen.bi.no/bi-xmlui/handle/11250/2688689

http://www.drvkumar.com/wp-content/uploads/2018/01/PCE-Chapter-9.pdf

Picture source (Header):

https://www.freepik.com/photos/gift; Gift photo created by lookstudio